Do you want to start SIP in a mutual fund scheme? If you are using Groww Application for investment then here we will explain step by step how to start SIP on Groww App.

Table of Contents

What is SIP & its Benefits?

SIP, or Systematic Investment Plan, is a simple and effective way to invest in mutual funds. It allows you to invest a fixed amount of money at regular intervals, such as every month or every quarter. This helps you average out your costs over time and reduce your risk.

Imagine you’re investing in a mutual fund that tracks the stock market. If you invest a lump sum all at once, you could end up buying more shares when the market is high and fewer shares when the market is low. This would reduce your overall returns.

With SIP, you invest a fixed amount of money every month, regardless of the market conditions. This means that you’ll buy more shares when the market is low and fewer shares when the market is high. Over time, this helps you to average out your costs and achieve better returns.

SIP is a great way to invest for the long term. It’s a disciplined way to save money and build wealth. And it’s easy to do, even if you’re a beginner investor.

Here are some of the benefits of investing in SIPs:

- Affordability: You can start SIPs with as little as ₹500 per month.

- Ease of use: You can set up SIPs online and automate your investments.

- Flexibility: You can choose the frequency and amount of your investments.

- Risk reduction: SIPs help you to average out your costs over time and reduce your risk.

- Power of compounding: SIPs allow you to take advantage of the power of compounding, which can help you to grow your wealth over time.

If you’re looking for a smart and easy way to invest in mutual funds, SIPs are a great option.

How To Start Mutual Fund SIP on Groww Step by Step

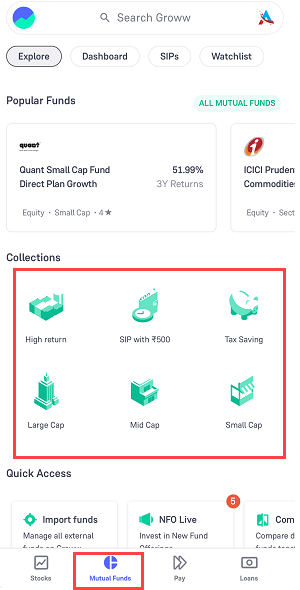

Step 1: Login to Groww Application and open the “Mutual Funds” section. Here you can see many different mutual fund schemes available to invest. If you want higher returns with high risk then choose MidCap and SmallCap mutual funds & if you want to take low risk then you can choose Largecap mutual funds.

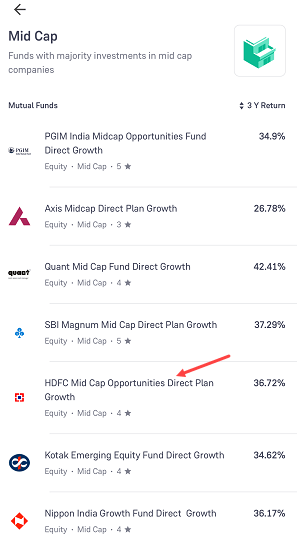

Step 2: I have selected “MidCap” mutual funds and here I’m going to start SIP in the “HDFC small cap mutual fund scheme” as you can see in the below screenshot.

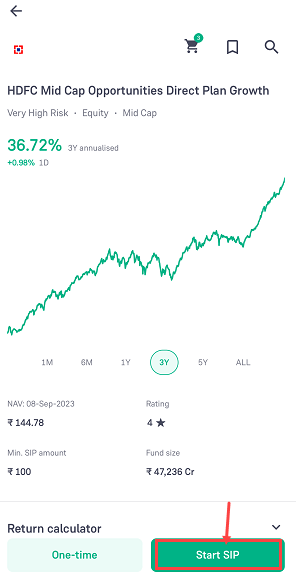

Step 3: Next screen you can see the selected mutual fund scheme performance and chart. Tap on the “Start SIP” button.

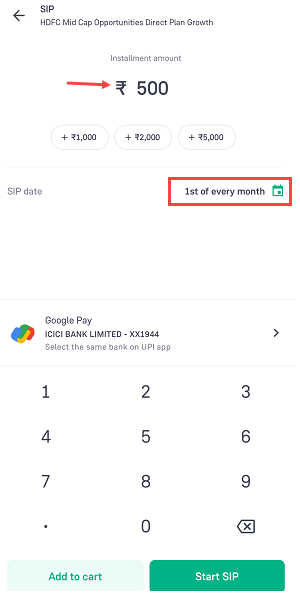

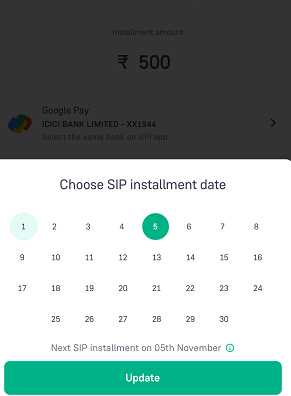

Step 4: Next screen enter the SIP amount. Here I will enter 500 INR. Now select the SIP date, tap on the date option.

Step 5: You can select any date for SIP. You need to pay your SIP on selected date every month.

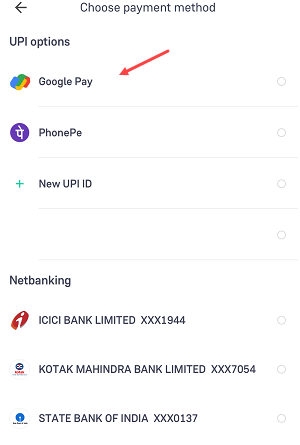

Step 7: After selecting your SIP date, now you pay the SIP amount using UPI and net banking. select your payment method and pay the SIP amount.

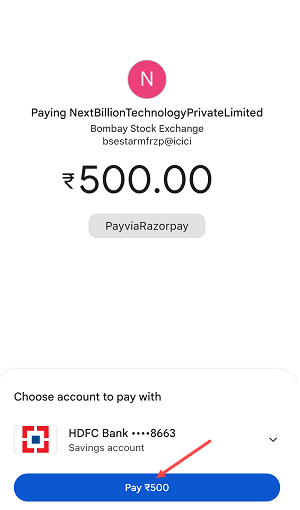

Step 8: Now Pay you first SIP amount.

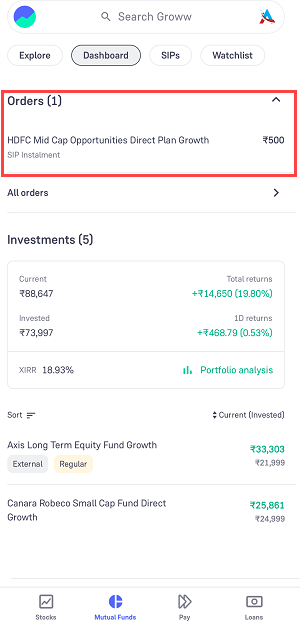

Step 9: After successful payment, your SIP will be activated. You can see your SIP order in the mutual fund section. Currently, your SIP is under process. Wait for 4-5 days to process your SIP order. Once your SIP is processed you can see your investment in the mutual fund dashboard.

Set up Auto Pay for SIP

Autopay SIP is a feature that allows you to automate your SIP investments. This means that you can set up a recurring mandate with your bank, and your SIP investments will be debited from your bank account automatically on a regular basis.

You can set up auto-pay for your SIP on Groww App in the Bank Details section.

Once you have set up autopay SIP, your SIP investments will be debited from your bank account automatically on the selected date. You can change the date of your SIP investments at any time.