HDFC Bank customers can send money to any bank account via UPI without UPI PIN. Yes, you can transfer money from your bank account through UPI without entering the UPI PIN.

In today’s fast-paced digital world, sending money has become more convenient than ever before, thanks to the revolutionary Unified Payments Interface (UPI) system. However, amidst the convenience, we often encounter the hurdle of remembering and inputting our UPI Personal Identification Number (PIN) every time we wish to make a transaction. But what if there was a way to send money without the need for this PIN?

In this article, we will tell you how to send money from your HDFC Bank account through UPI without UPI PIN.

HDFC Bank UPI Money Transfer Without UPI PIN

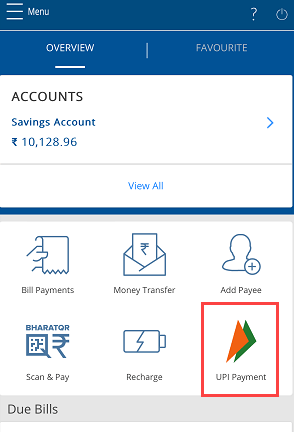

Step 1: Login to your HDFC mobile banking application and go to the “UPI Payment” section. You don’t need to rely on other UPI applications, your HDFC mobile banking has this feature.

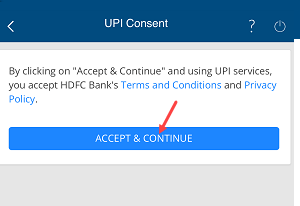

Step 2: Next screen, tap on the Accept and Continue button and proceed.

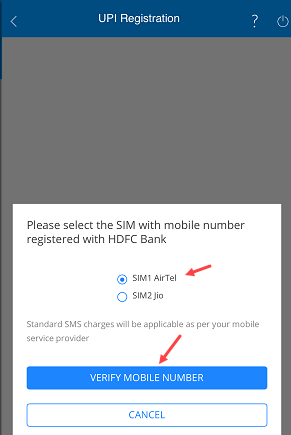

Step 3: Next screen you need to select the SIM with mobile number registered with your HDFC Bank account and verify your mobile number by SMS. The application will send an SMS from your HDFC-registered mobile number to verify your number.

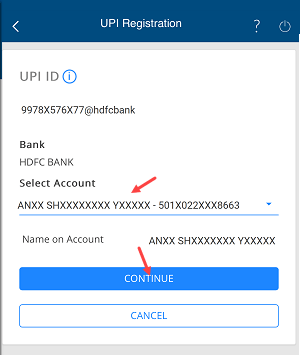

Step 4: After verifying your HDFC bank registered mobile number, you can see your HDFC bank account on the next screen, select your bank account and click on continue.

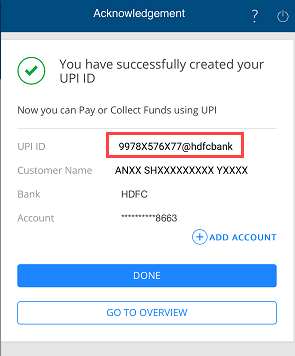

Step 5: Congrats, Your UPI account is created successfully. Now you will be able to send money without a UPI PIN from your UPI account created on HDFC mobile banking.

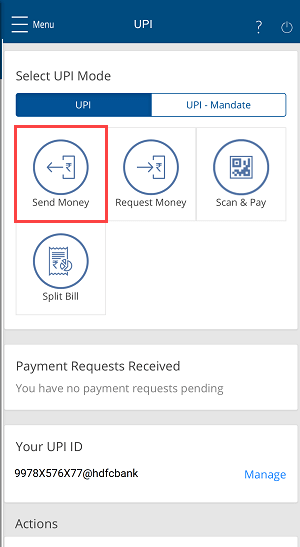

Step 6: Now you are ready to send money from your HDFC Bank account to any bank account via UPI without UPI PIN. Just tap on the “Send Money”

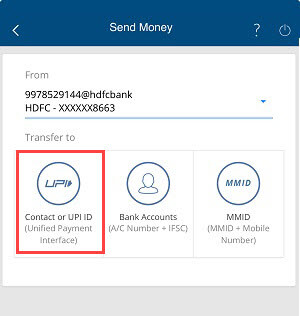

Step 7: Nxt screen you need to select the “Contact or UPI ID” option if you want to send money using UPI ID and mobile number. If the receiver has shared his/her bank account details like account number an IFSC code then you can choose “Bank accounts” option too.

Step 8: Next screen enter the UPI ID of the receiver (Beneficiary) OR Mobile number. Enter the amount, type remarks and click on continue.

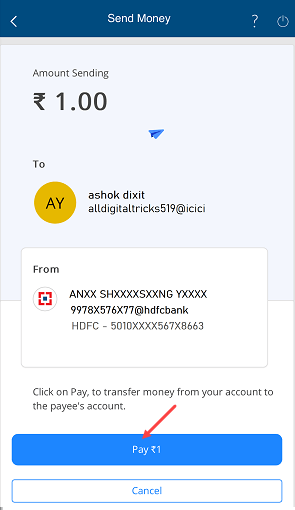

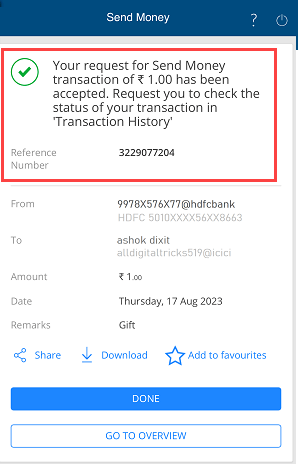

Step 9: Next screen confirm your transaction by clicking on the Pay button.

That’s all. You have successfully sent the money to the beneficiary account without entering the UPI PIN.

In conclusion, the ability to send money without the reliance on a UPI Personal Identification Number (PIN) directly from an HDFC bank account is a significant leap forward in the realm of digital banking and financial convenience. With this innovative feature seamlessly integrated into HDFC’s mobile banking platform, customers can experience greater ease and efficiency in managing their financial transactions.

So if you want to send money from your HDFC Bank account without UPI PIN then you can use HDFC mobile banking inbuilt UPI service.