SBI customers don’t need any third-party application for UPI money transfers. Yes, you can directly transfer money through UPI using SBI Mobile Banking SBI YONO Lite. You can transfer up to 1 lac to any bank account using the UPI transfer facility available in SBI YONO Lite.

Through SBI YONO Lite UPI transfer facility, you can transfer money to any bank account using UPI ID & account number+IFSC code. And here you don’t need to set UP a UPI PIN and no need to enter the UPI PIN during the fund transfer. You just need to enter the OTP received on your registered mobile number to complete the transfer.

So here we will guide you, how to make UPI money transfer using SBI Mobile Banking (YONO Lite)

Table of Contents

UPI Money Transfer using SBI YONO Lite Mobile Banking

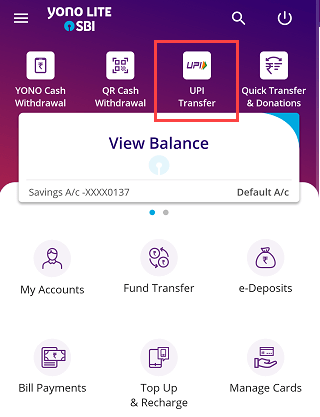

Step 1: Open SBI YONO Lite application and login to your account. After login, tap on “UPI Transfer” option.

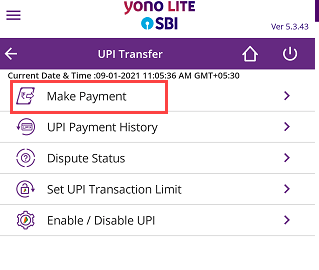

Step 2: Now tap on the “Make Payment” option

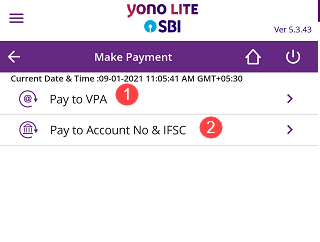

Step 3: Next screen, you can see two options for UPI money transfer

1. Pay To VPA mean UPI ID:

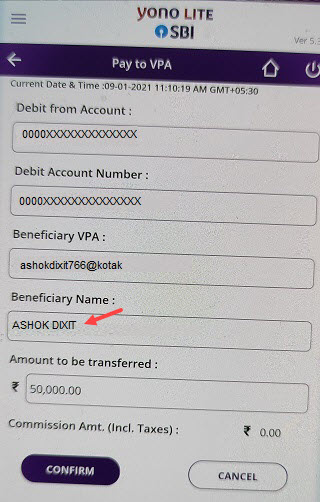

If you know the beneficiary’s UPI ID then you can select this option and enter his/her UPI ID and transfer money to his/her bank account.

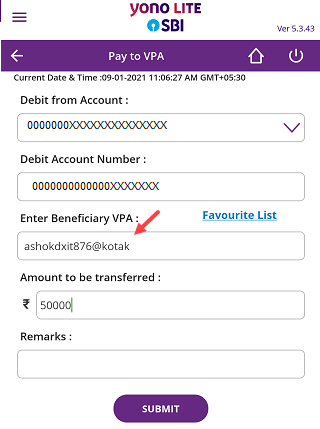

Select your bank account and enter beneficiary VPA (UPI ID), enter the amount, and submit.

Next screen, you can see the beneficiary name (account holder), if the details are correct, click on confirm.

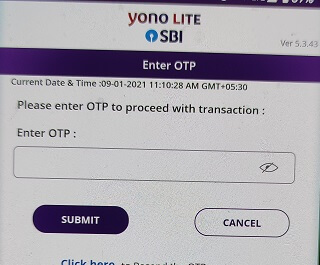

And finally, enter the OTP and confirm your transaction. After entering OTP, your UPI transfer will be successful and the amount will be credited to the beneficiary account.

2. Pay to account No & IFSC:

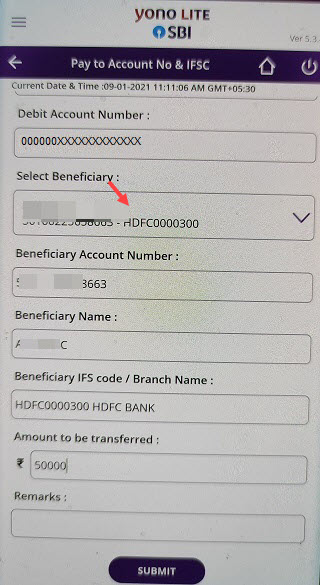

If you don’t know the beneficiary’s UPI ID and you have his/her bank account number and IFSC code then you can add his/her bank account as a beneficiary and transfer money to his/her bank account.

First, you need to add his/her bank account number as a beneficiary which you can do through Mobile banking in the fund transfer section.

Select Pay to Account No & IFSC option.

Next screen, select your account number and select an added beneficiary, enter the amount and submit. Enter OTP and confirm your transaction.

Frequently Asked Questions

(1) Can I transfer money from my SBI account through UPI without UPI PIN & Debit Card?

Ans: Yes, if SBI mobile banking (YONO Lite) is active on your phone then you can transfer money through UPI and you don’t need to enter a UPI PIN. You just need to confirm your transaction through OTP.

(2) What is the maximum limit for SBI Mobile Banking UPI Transfer?

Ans: Maximum limit is 1 lac.