SBI customers can send money to any bank account without adding beneficiaries through Mobile Banking and net banking. Yes, you can transfer up to Rs.25,000 per day to any bank account using the Mobile banking and net banking channels, and no need to add a bank account as the beneficiary.

SBI Quick transfer now lets you transfer money to any bank account without registering a beneficiary account.

Normally, when you transfer a huge amount (above 25,000) from your SBI account to any other bank account, you need to add the receiver account as the beneficiary and after activation of the beneficiary account, you will be able to transfer money to his/her account.

But now Quick Transfer facility lets you send upto 25,000 amount instantly from your SBI account to any other bank account without adding a beneficiary.

Table of Contents

1. SBI Quick Transfer Using Mobile Banking Without Adding Beneficiary

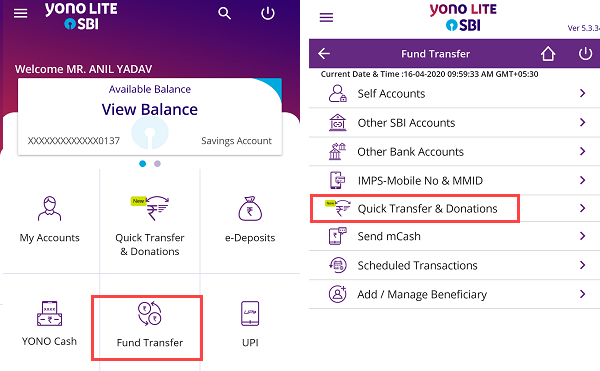

Open SBI Mobile Banking YONO Lite application.

Tap and open Fund Transfer – Quick Transfer

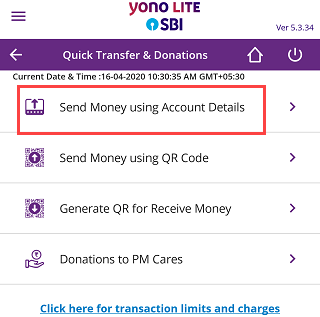

Next screen select Send Money Using Account Details.

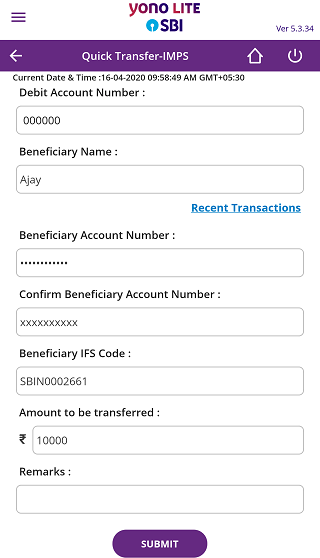

Now select your account number, enter the beneficiary name, account number, IFSC code, and amount (up to 25,000) and submit.

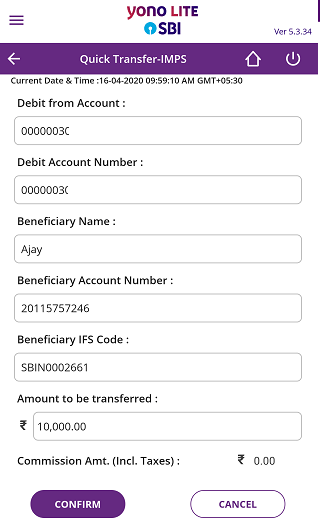

Next screen check your details and amount and confirm.

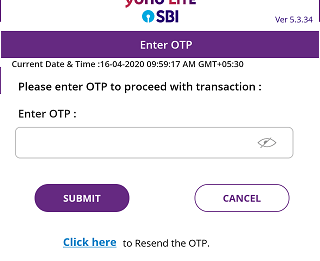

Enter OTP received on your registered mobile number and confirm your payment.

That’s it the amount will be transferred to the beneficiary account instantly.

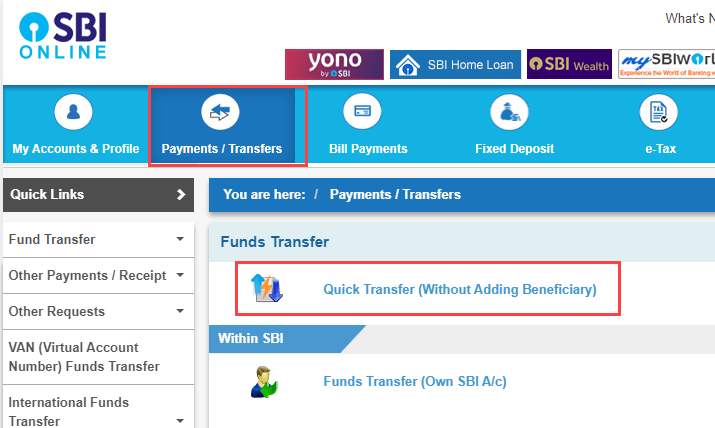

2. SBI Quick Transfer using Net Banking – Send money Without Adding Beneficiary

You can also use SBI Internet banking for a Quick transfer facility and transfer money to any bank account without adding as a beneficiary.

Login to SBI Internet Banking.

Now click on the Payments/Transfer tab and select Quick Transfer (Without Adding Beneficiary)

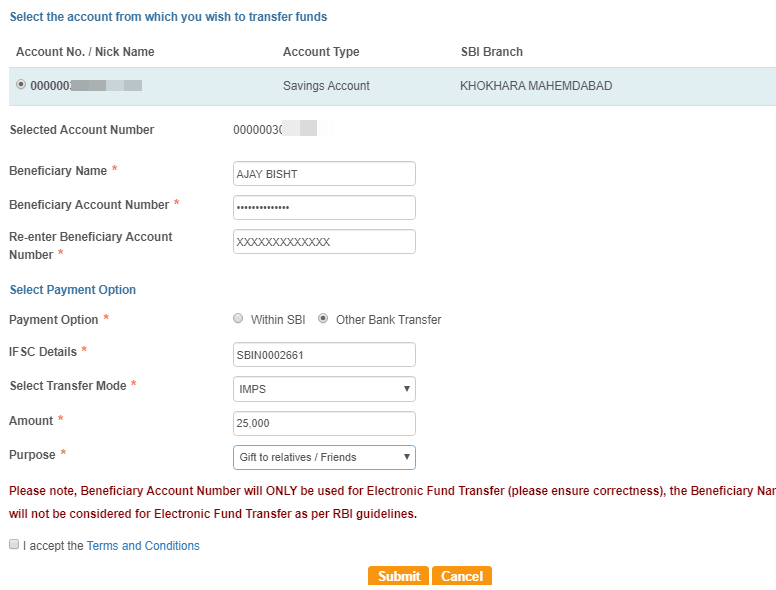

Next screen select your Debit account number, enter the beneficiary name, his/her account number, IFSC code (if you select another bank), enter the amount, select IMPS in transfer mode and submit.

If you are going to transfer money to any SBI account then you don’t need to enter the IFSC code. IFSC code is only required when you transfer money to other bank accounts except for SBI.

Please note:

- Please note High-Security Password (OTP) is mandatory for Quick fund transfers.

- Please note that the maximum amount for Quick Fund per transaction is Rs.25,000/-.

- Please note that the maximum amount should not exceed the limit Rs.25,000/- for the day.

FAQ

Q.1: Can I send money without adding beneficiaries in SBI?

Ans: Yes, SBI Quick transfer facility now lets you transfer up to INR 25,000 to any bank account without adding as a beneficiary.

Q.2: How much can be transferred without adding beneficiaries in SBI?

Ans: You can transfer up to INR 25,000 daily from your SBI account to any bank account without adding a beneficiary.

Q.3: Charges for SBI Quick transfer?

Ans: The bank has waived off IMPS charges so the charges are NIL.

Q.4: SBI Quick transefer timing?

Ans: This facility is available 24/7 so you can transfer money anytime.