The UPI Lite transaction limit is Rs 500 per transaction and Rs 2,000 per day. This means that you can make up to 4 UPI Lite transactions per day, each with a maximum value of Rs 500.

It is important to note that the overall limit for offline transactions on a payment instrument remains Rs 2,000 at all times. This includes both UPI Lite transactions and National Common Mobility Card (NCMC) transactions.

The UPI Lite transaction limit was increased from Rs 200 to Rs 500 on August 10, 2023, by the Reserve Bank of India (RBI). This was done to promote the adoption of UPI Lite and make it more convenient for users to make small-value payments.

UPI Lite is a great way to make small-value payments quickly, easily, and securely. It is free of charge and easy to use, making it a great option for everyone.

No UPI PIN, no problem! Pay ₹500 on PhonePe with UPI Lite

First, you need to add money to your PhonePe UPI Lite account using your linked bank account. Here is the steps:

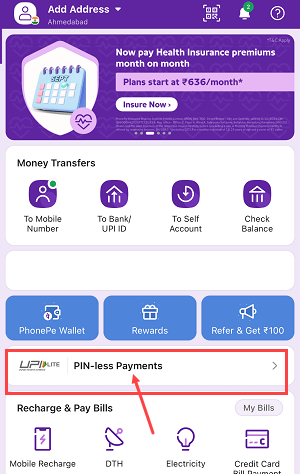

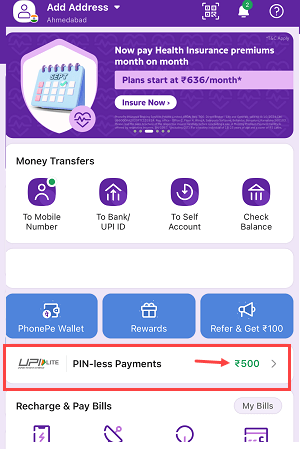

Step 1: Open your PhonePe app and you’ll see a “UPI Lite – PIN less payments” option on the home screen. Tap on it to select this option.

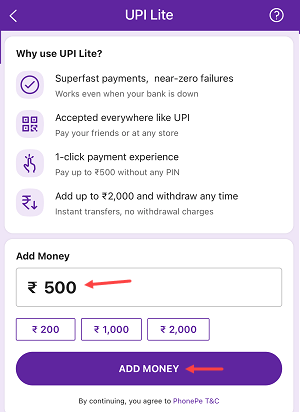

(2) On the next screen, enter the amount you want to add to your PhonePe UPI Lite account. The maximum limit is Rs.2000. Once you’ve entered the amount, tap on “Add Money”.

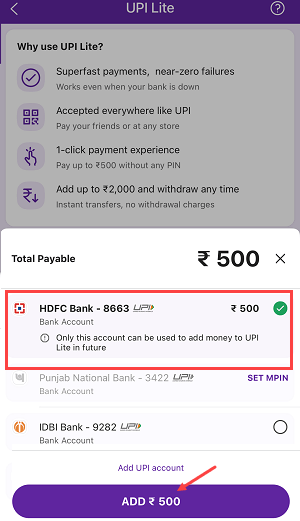

(3) On the next screen, select the bank account that you want to use to add money to your UPI Lite account. This will be your default bank account for future transactions. Once you’ve selected the bank account, tap on the “Add” button.

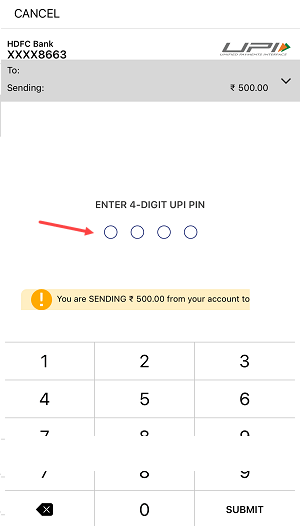

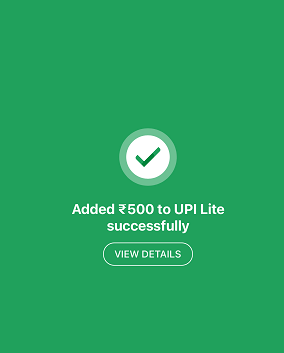

(4) On the next screen, you’ll be prompted to enter your 4-6 digit UPI PIN. Once you’ve entered the PIN, tap on “Submit” to complete the transaction.

(5) Congratulations! You’ve successfully added money to your UPI Lite account. You can now use this money for payments. You can pay or send a maximum of 500 INR in a single transaction without using your UPI PIN.

Now you can view your UPI Lite account balance on the home screen as you can see in the below screenshot.

Now you are ready to use your UPI Lite account for smaller payments. You can now pay up tp INR 500 per transaction. Here is how to do that:

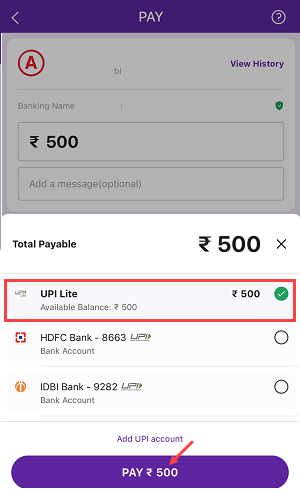

Simply select any payment method and on the payment page, choose the “UPI Lite” option. If you’re paying 500 or less, you won’t need to select your bank account. Just choose “UPI Lite” and pay or send money from your UPI Lite account without UPI PIN.

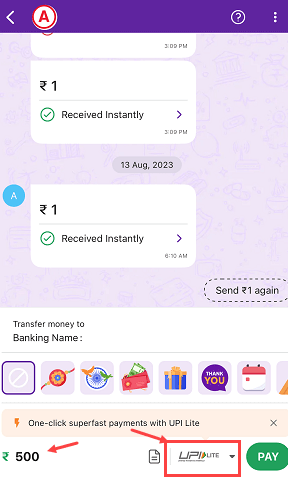

If you’re sending money on the chat screen, select the “UPI Lite” option and pay the amount from your UPI Lite account.

PhonePe UPI Lite is a significant development in the digital payments landscape in India. It allows users to make small-value transactions up to Rs 500 without having to enter their UPI PIN each time. This makes it a faster, more convenient, and more secure way to make small payments.