We have received comments from several readers who have asked us to provide a comprehensive, step-by-step guide on how to check and approve IPO mandate requests through the Axis Mobile Banking App. In this guide, we will give you a detailed explanation of how to create an IPO mandate request and approve it using the Axis mobile banking application.

If you are an Axis Bank customer and using Axis mobile banking then you can follow this complete guide to apply IPO and approve the mandate request. Read also: How to change Axis Bank Account registered mobile number online

Table of Contents

How To Check and Approve IPO Mandate on Axis Mobile Banking App

First of all, make sure you have an active Axis mobile banking app. You can install the Axis Mobile App from the Play Store and Apple Store and register for mobile banking. Non-Axis Bank customers can install the Axis BHIM Pay app to approve the IPO mandate request.

Once you have activated the Axis Mobile Banking app, you need to create your UPI account on Axis Mobile Banking and create your UPI ID.

Once you are done, let’s apply for an IPO, create an IPO mandate request and then approve it from the Axis Mobile Banking App.

Apply IPO and Create Mandate Request using Axis Mobile UPI ID

We will apply for IPO and create a UPI mandate request by login in to the Demat account. Later we will approve this mandate request and complete the IPO application.

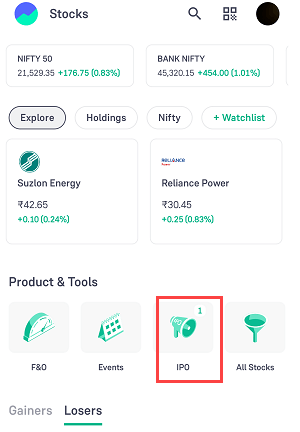

Step 1: Login to your Demat account and go to the IPO section. Here we are using Groww App. The process remains the same, so you can use any Demat account app such as Zerodha, Angel One, or Upstox.

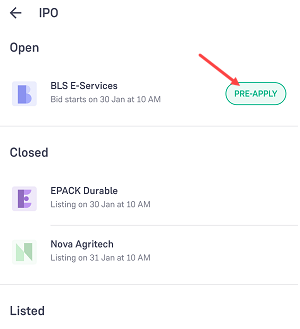

Step 2: Once you open the IPO section, select your IPO and click on the Apply button.

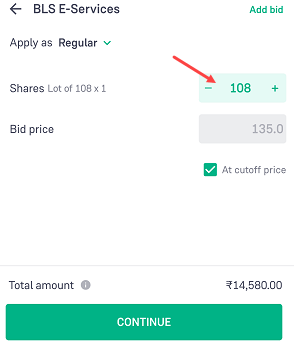

Step 3: Next screen, you need to select lot numbers and proceed to the next step.

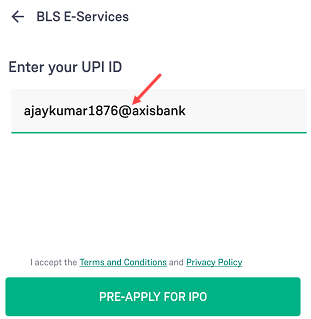

Step 4: Now enter your Axis mobile Bankin UPI ID and submit your IPO application.

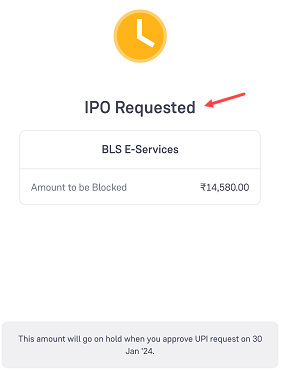

That’s all you have successfully created an IPO mandate request using your Axis Bank UPI ID. Your mandate request has been sent to the Axis Mobile Banking App for approval.

Approve IPO Mandate Request on Axis Mobile Banking App

Once you create an IPO mandate request, please wait for 10-15 minutes to receive the request on Axis Mobile Banking. You will receive an SMS from Axis Bank once the mandate request is received on the Axis Mobile Banking app.

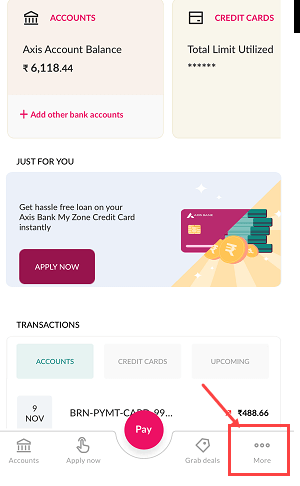

Step 1: Now login to the Axis Mobile Banking App and tap on the “More” section.

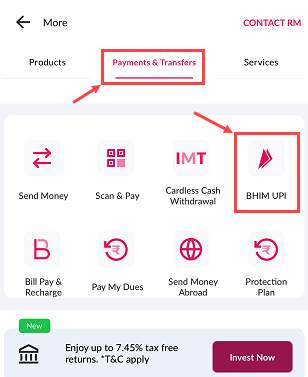

Step 2: In the more section, tap on the “Payment & Transfers” section and select the “BHIM UPI” option as you can see in the below screenshot.

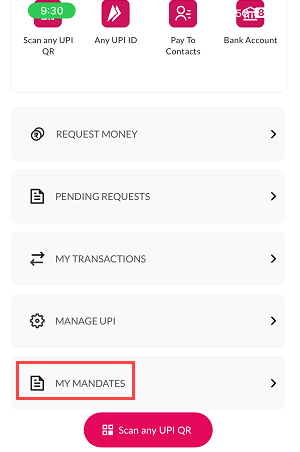

Step 3: In the BHIM UPI section, swipe up a little and you can see the “My Mandates” option, tap and open this option to view and approve your mandate request.

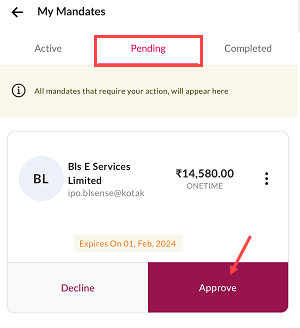

Step 4: Now open the “Pending” section where your IPO mandate request is waiting for your approval. Tap on the “Approve” button and proceed.

Congrats, you have successfully approved your IPO UPI mandate on the Axis Mobile Banking application and your IPO application has been completed and submitted.

What Next After Accept IPO Mandate on Axis Mobile App

Once you approve the IPO mandate request on the Axis Mobile Banking App, the IPO amount will be blocked in your Axis Bank account and you will receive SMS from the bank for this transaction.

After submitting your IPO application, you need to wait for the allotment date. If your application is successful and you are allotted shares, the amount will be debited from your bank account and the shares will be credited to your Demat account once the IPO is listed.

If you are not allotted IPO shares, a refund will be initiated and your funds will be unblocked within 7 days. You can track the status of your refund from your Demat account.

I hope you found this step-by-step guide helpful for finding and approving an IPO UPI mandate request on the Axis Mobile Banking app. If you are an Axis Bank customer, you can easily apply for an IPO and accept mandate requests through the mobile banking app.