Do you want to enable the Auto sweep facility for your SBI account? If yes then you can enable this facility online using net banking. Here we will tell you step by step.

When you enable auto sweep for your saving/current account, the balances in the Savings / Current account will be transferred automatically by means of auto sweep facility to term deposit / special deposit account on a weekly basis, whenever there are surplus funds in the account.

Table of Contents

Enable Auto Sweep Facility Online for SBI Account

Step 1: Login to SBI internet banking (https://retail.onlinesbi.sbi/retail/login.htm)

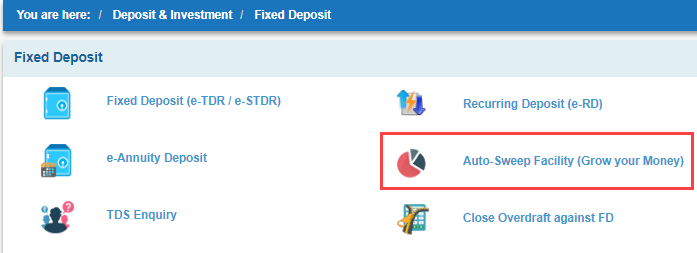

Step 2: After login, click on “Deposit & Investment” and open the “Deposit” section as you can see in the below screenshot.

Step 3: In the Deposit section, you can see the “Auto-Sweep Facility (Grow your Money)” option, click on this option.

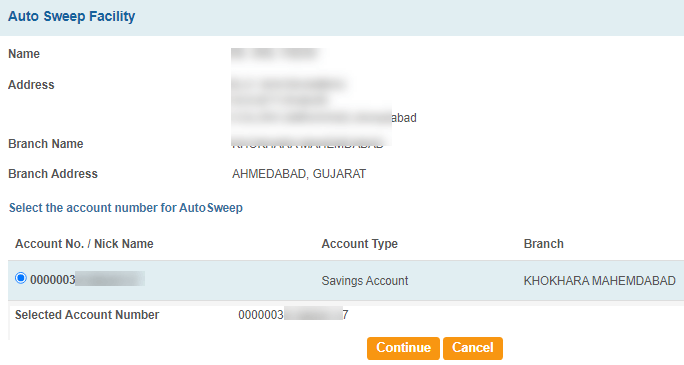

Step 4: Next screen, select your account number and press the continue button. You need to verify your request by entering the OTP received on your mobile number.

What is the auto-sweep facility?

The auto-sweep facility is a mixture of savings accounts and FD accounts. It has the advantage of both facilities. With an auto-sweep account, your savings account is linked to a fixed deposit account and a monetary limit is defined. Whenever the amount in the savings account crosses that defined limit, the excess money is transferred automatically into the fixed deposit. This way, your savings account balance can earn a higher rate of interest.

Please note:

- Accounts once converted cannot be changed back to the previous Product Type. If you want to change, please visit your home branch.

Savings Plus Account is a Savings Bank Account linked to MODS, wherein surplus fund above a threshold limit from the Savings Bank Account is transferred automatically to Term Deposits opened in multiples of ₹1000.

- Any surplus funds retaining a minimum of ₹25000 in Savings Bank (to be set up by the customer) will be transferred as Term Deposit with a minimum of ₹10000 and in multiple of ₹1000 at one instance

- The account holder can choose the period of deposit from 1 year to 5 years.

- Payments in excess of the available balance in the Savings bank Account can be made by breaking MODs Last In First Out.