There are many UPI applications available on the Play Store and Apple Store to access UPI services. However, if you are an HDFC Bank customer then you don’t need third-party apps to send and receive money through UPI.

You can use HDFC mobile banking’s inbuilt UPI facility and create your UPI account & UPI ID on mobile banking and yes you don’t need to set up a UPI PIN when you create a UPI account on HDFC mobile banking on the other hand, when you create your UPI account on other UPI applications, you need to create UPI PIN and enter the PIN every time to send or pay money.

Create HDFC Offical UPI Account and UPI ID on Mobile Banking

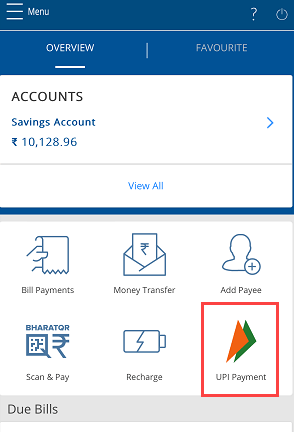

Step 1: Open your HDFC mobile banking application and login. You will find the “UPI Payment” section here. Just select this option and proceed to create your official UPI account and UPI ID.

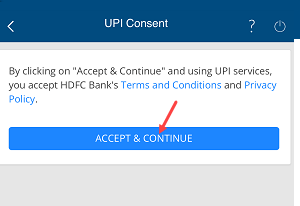

Step 2: Next screen accept terms and conditions and tap on the continue button.

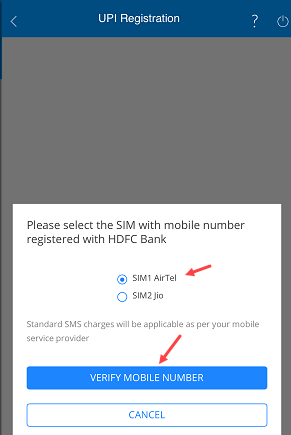

Step 3: Now your HDFC bank registered mobile number will be verified by sending an automatic SMS. Select your registered mobile number SIM and tap on the Verify mobile number. Make sure you have enough balance to send an SMS.

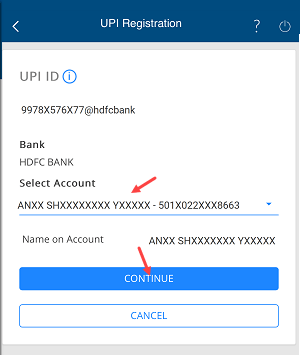

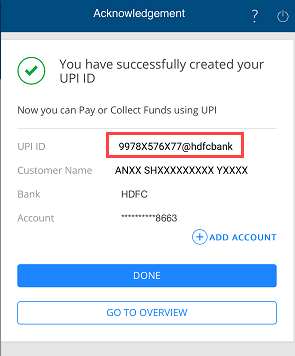

Step 4: After your registered mobile number validation, you can see your UPI ID is generated with @hdfcbank. Next screen you need to choose your HDFC account number and tap on the continue button to link your bank account with this UPI ID.

Step 5: Congrats, you have successfully created your UPI account on HDFC mobile banking and you can see your official UPI ID with @hdfcbank. Normally your UPI ID will be created with your mobile number.

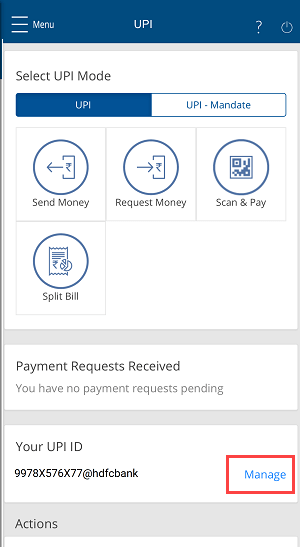

Step 6: Now you can open the “UPI Payment” section on mobile banking and use UPI services like sending and receiving money via UPI. The good thing is that you don’t need to set up your UPI PIN when you create your UPI account on HDFC mobile banking.

So if you don’t want to use any other UPI application for your HDFC account then you can try the HDFC mobile banking UPI payment feature and create your UPI account with a unique UPI ID.