Canara Bank customers can subscribe monthly email statement facility by registering an email ID with a bank account and get an account e-statement every month. You can check your account transaction details every month by activating an email statement facility for your account.

After registering for Canara monthly email statement facility, you will receive your account statement every month on your registered email ID. This e-statement facility is really very helpful for those who are unable to visit the bank to check account transaction history by printing a physical passbook.

See how you can register for Canara monthly e-statement facility?

- Read also: How to Download Canara Bank Statement

Canara Bank Monthly e-Statement Registration

First, you need to register your email ID with the bank account. You need to visit the bank to link your email Id with the bank account. If your email ID is already registered with a bank account then follow the below steps and register for the e-statement facility.

Open Canara Bank Internet banking and login to your account.

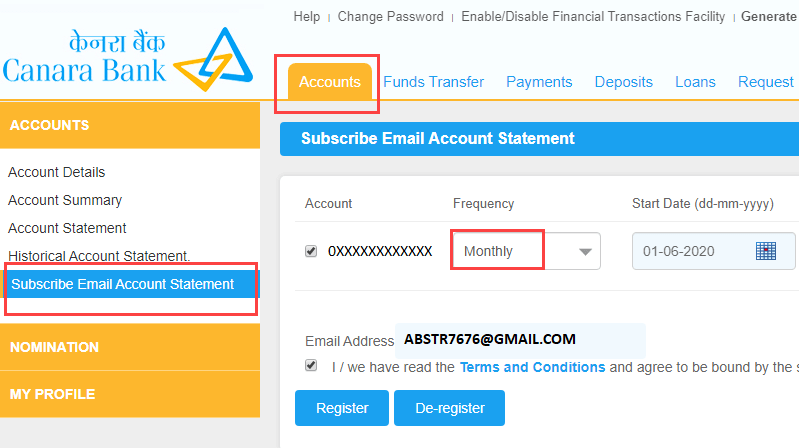

Now click on Accounts – Subscribe Email Account Statement. Select your account number, select monthly frequency, select start date, and click on register. (You can also select quarterly, weekly, and other frequency for e-statement)

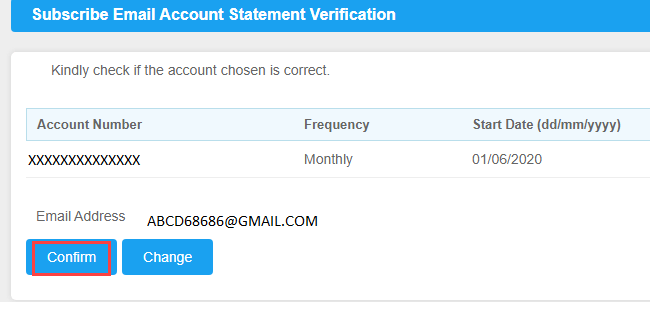

Next screen confirm your request.

Congrats, you have successfully subscribed monthly email statement facility for your Canara bank account.

Frequently Asked Questions

(1) What is the Canara e-statement facility?

Ans: Canara email statement (e-statement) facility enables you to get an account statement every month on your registered email ID. You can activate this facility by registering your email ID with the bank.

(2) Is this e-statement facility is free?

Ans: Yes, the e-statement facility is free and you don’t need to pay anything. Just register your email ID and subscribe through net banking.

(3) Is there any other way to check my detailed statement in Canara bank?

Ans: Yes, you can download the account statement by login to net banking and also activate the mPassbook facility on your phone.