Investing in Initial Public Offerings (IPOs) has become increasingly popular among retail investors. If you’re looking to participate in this exciting market, knowing how to approve IPO mandate requests on the SBI Pay UPI App is essential. This process not only simplifies your investment experience but also ensures that your funds are securely managed.

The SBI Pay UPI App offers a user-friendly platform for approving IPO mandate requests, allowing you to streamline your investments with ease. In this guide, we will walk you through each step required to approve your IPO mandate request efficiently, so you can focus on maximizing your investment opportunities.

Table of Contents

How to Approve IPO Mandate Request on SBI Pay UPI App

Before you proceed, ensure you have the following:

- Registered with the SBI Pay UPI App: If you haven’t registered yet, download the app and follow the on-screen instructions to create your account.

- Linked Bank Account: Make sure your bank account is linked to the SBI Pay UPI App.

- Valid UPI ID: A valid UPI ID is necessary to complete the IPO application process.

Steps to Approve IPO Mandate Request

Step 1: Apply for IPO

Use your Demat account application, such as Zerodha, Groww, or Angel One, to apply for the IPO using your SBI Pay UPI ID. Ensure you place your IPO order during market hours, which are between 10 AM and 12 PM. After submitting your mandate request, you will receive the IPO mandate request on the SBI Pay App within four hours.

Step 2: Open the SBI Pay UPI Application

Launch the SBI Pay UPI App on your device.

Step 3: Login with Your MPIN

Enter your MPIN to log in securely.

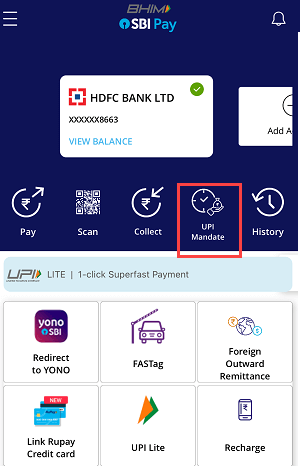

Step 4: Navigate to UPI Mandate

On the home screen, look for the UPI Mandate option and click on it to open.

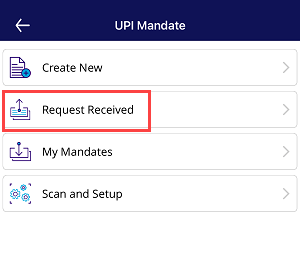

Step 5: View Request Received

In the next screen, click on the Request Received option to view your mandate requests.

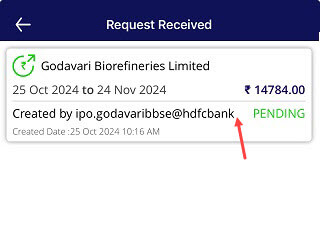

Step 6: Open IPO Mandate Request

Find your IPO mandate request and click on it to open.

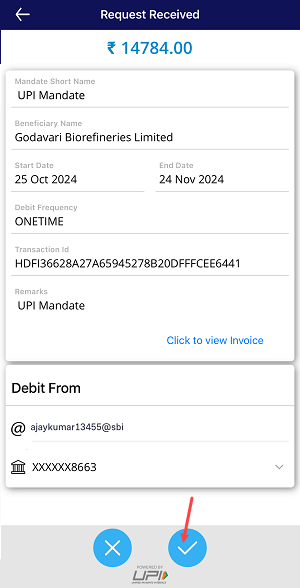

Step 7: Approve the Mandate

Finally, click on the Approve button.

Step 8: Enter UPI PIN

Enter your UPI PIN to complete the approval process.

Confirmation of Approval

Once you’ve successfully entered your UPI PIN, your IPO mandate request will be approved. The IPO amount will be blocked in your bank account until the allotment process is complete. If you receive an allotment, the amount will be debited from your account automatically. In the unfortunate event that you do not receive an allotment, the blocked amount will be unblocked within 24 hours.

Conclusion

Following these simple steps, you can easily approve your IPO mandate request on the SBI Pay UPI App. Make sure to keep your app updated and monitor your notifications for a seamless investing experience. Happy investing!