Finally, the Post office of India has launched India Post Payments Bank in the country. You can open India Post Payments Bank (IPPB) saving account online. IPPB account opening process is paperless and can be opened through IPPB’s official mobile banking application.

You just need Aadhaar Card and PAN CARD to apply India Post Payments Bank saving account online.

India Post Payments Bank Account Features:

- Zero balance account opening

- Paperless account open process at home

- Mobile Banking, SMS Banking, and Missed call banking

- Online Money transfer facility through IMPS, NEFT and RTGS

- Cash withdrawal and Deposit Facility at the doorstep

- Earn 4% Interest rate

- Savings and Current Accounts can be open

And here is the online account opening process through IPPB Mobile Banking.

Apply IPPB Saving Account Online

All you need to Install the IPPB Mobile Banking application which is available on the Android Platform.

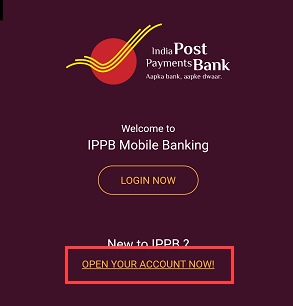

1# Install IPPB Mobile Banking application from play store and open it, on the first screen tap on “Open Your Account Now”

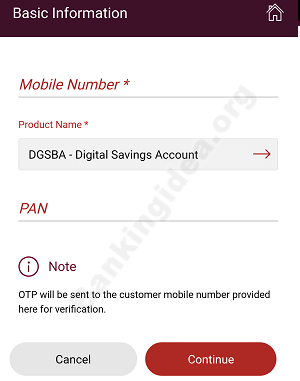

2# Now enter your mobile number and PAN Card number and tap on continue.

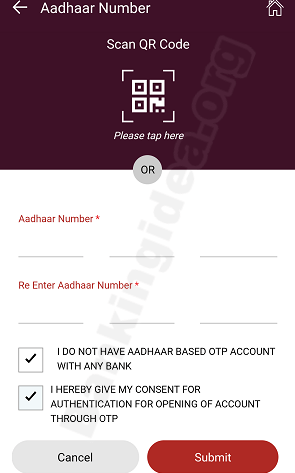

3# Next screen enter your Aadhaar card number, you can also scan the Aadhaar QR code to detect your number. Accept terms and tap on submit.

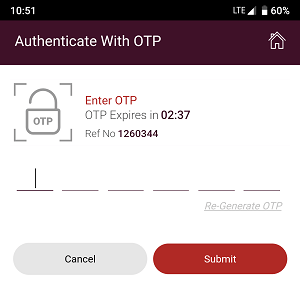

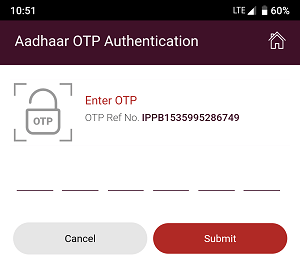

4# Now you will receive a One Time Password (OTP) on your entered mobile number. Type OTP and submit.

5# On the next screen, you will receive OTP on your Aadhaar card registered mobile number. You need to enter this OTP to verify your Aadhaar. Enter and submit.

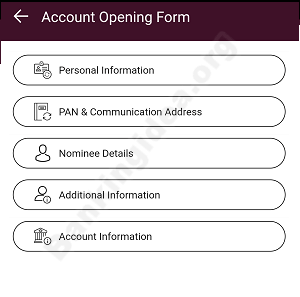

6# Next screen enter Personal, Address, account, and additional information. You can also add a nominee here (optional). After entering all these details tap on continue.

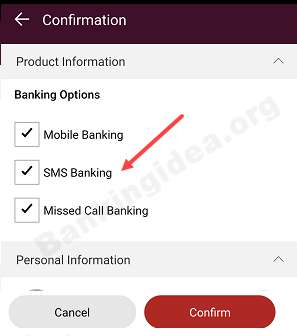

7# Next screen check all SMS Banking, Mobile Banking, and Missed call Banking facility. Confirm your all entered details are correct and tap on Confirm.

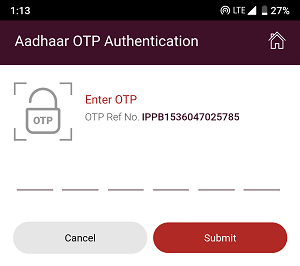

8# And in the last step, you will receive another OTP on your Aadhaar card registered mobile number, enter the OTP and submit.

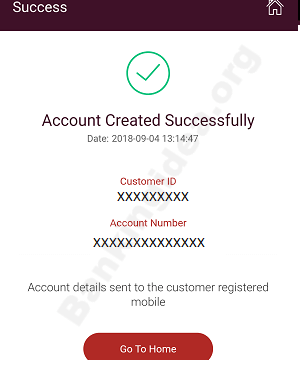

Congrats, you have successfully opened an IPPB saving account online. You can see your Customer ID and Account number. You will also receive an SMS on your registered mobile number containing the account number and Customer ID.

After account opening, you can now activate IPPB Mobile Banking and register your account using your customer ID and Account number. You can use mobile banking for banking services like money transfers, balance inquiries, and more.

I hope you understand, how to open India Post Payments Bank (IPPB) saving account online.