Adding a beneficiary account in the Bank of Baroda mobile banking app (bob World) is essential to initiate money transfers securely and efficiently. Whether transferring funds to another Bank of Baroda account or an account in a different bank, registering the beneficiary ensures a smooth and error-free process. This step is mandatory to prevent unauthorized transactions and to enable seamless transfers via IMPS, NEFT, or RTGS once the beneficiary is verified and activated.

Table of Contents

How to Add a Beneficiary Account on Bank of Baroda Mobile Banking

Managing your finances with the Bank of Baroda (bob World) app is convenient and straightforward. One critical step to transferring funds is adding a beneficiary account. This guide walks you through the process step by step.

Steps to Add a Beneficiary in Bank of Baroda Mobile Banking

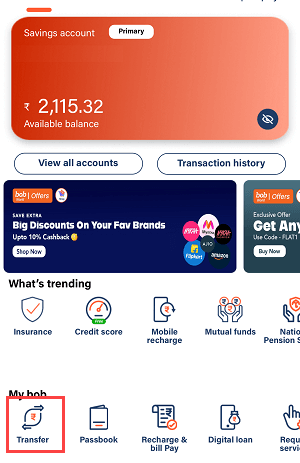

Step 1: Login and Navigate to Transfers

- Open the Bank of Baroda Mobile Banking (bob World) app.

- Enter your login credentials and tap on the Transfer option.

Step 2: Access Beneficiary Addition

- If no beneficiaries are added yet, you’ll see an Add Now option. Tap on it.

- If beneficiaries already exist, tap View All and select Add a New Beneficiary.

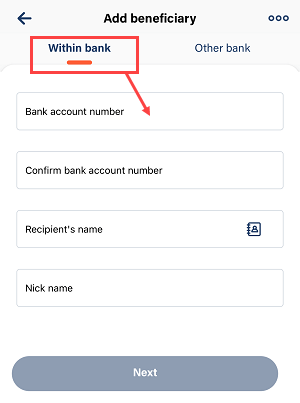

Step 3: Add a Beneficiary (Within Bank of Baroda)

- If the beneficiary has a Bank of Baroda account, choose the Within Bank option.

- Enter the beneficiary’s account number and name, then submit. You don’t need to enter the IFSC code for Bank of Baroda accounts.

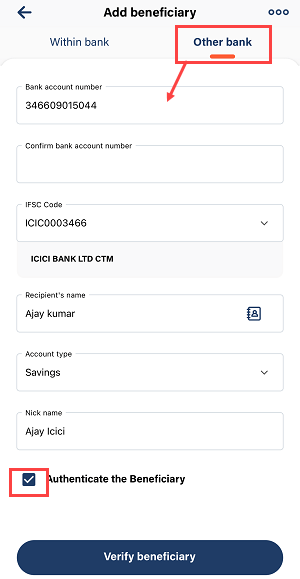

Step 4: Add a Beneficiary (Other Banks)

- If the beneficiary has an account in another bank, select the Other Bank option.

- Enter the following details:

- Account number

- Name

- IFSC code

- Nickname (optional)

- Select Authenticate Beneficiary and tap Verify Beneficiary.

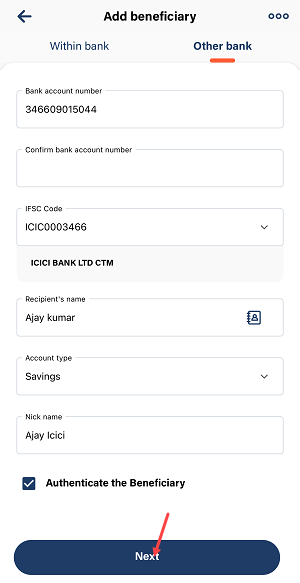

Step 5: Verify the Beneficiary

- After verifying the beneficiary details, tap the Next button.

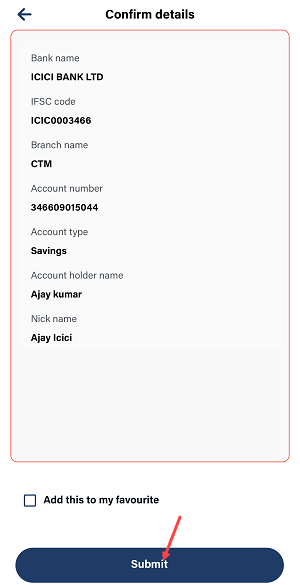

Step 6: Confirm Beneficiary Details

- Review the beneficiary’s account details one last time and tap Submit.

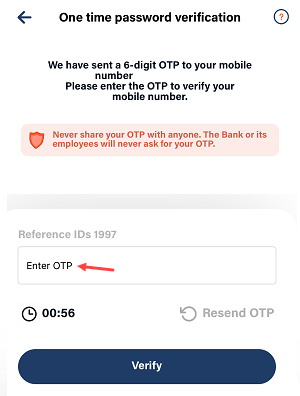

Step 7: Enter OTP

- An OTP will be sent to your registered mobile number. Enter the OTP to proceed.

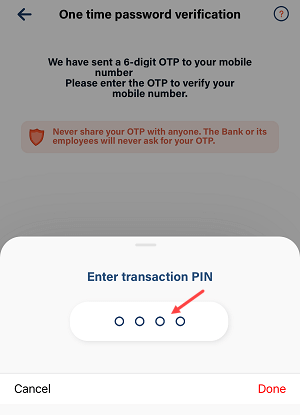

Step 8: Enter Transaction PIN

- Provide your transaction PIN and tap Submit.

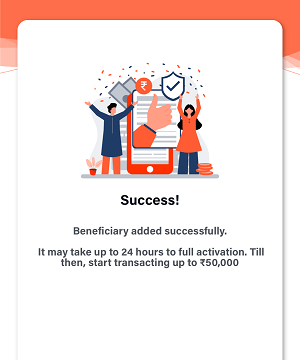

Step 9: Beneficiary Successfully Added

- The beneficiary account is now added successfully. The beneficiary will be activated after 4 hours.

Transfer Limits After Adding a Beneficiary

- After 4 hours, you can transfer up to:

- ₹50,000 via IMPS

- ₹50,000 via NEFT

- After 24 hours, transfer limits increase to:

- ₹5 lakh via IMPS

- ₹20 lakh via NEFT

Adding a beneficiary is a one-time step to enjoy smooth, hassle-free fund transfers through the Bank of Baroda mobile banking app. Follow this guide to set up your beneficiary account today!