MobiKwik has introduced a new feature called “Pocket UPI” that lets you transfer money without linking your bank account or entering a UPI PIN. This feature makes UPI transfers faster and smoother. With Pocket UPI, you can load up to 2 lakh in your Pocket wallet and use it to transfer money to any bank account or make payments. The best part is that you don’t need to enter a UPI PIN while using Pocket UPI.

Today I’m gonna tell you, how to activate the MobiKwik Pocket UPI wallet and complete KYC. If you are interested then follow our step-by-step guide here:-

What is MobiKwik Pocket UPI?

In simple terms, it is your digital wallet powered by UPI. Add up to 2 lakh money to your MobiKwik Pocket UPI wallet account using your linked UPI Bank account, debit card/credit card and use your wallet money for UPI money transfer, payments and more.

With MobiKwik Pocket UPI you can transfer up to lakh to any bank account using UPI ID, mobile number, and QR code and the good thing is that you don’t need to enter any UPI PIN. Just enter the amount and send it.

Similarly, you can pay at any shop through UPI from your Pocket UPI wallet and here you don’t need to authenticate your transaction with UPI PIN.

Overall, if you don’t want to link your Bank account for UPI money transfers and payments and still want to use UPI payments service then MobiKwik Pocket UPI is for you.

How To Activate & Complete MobiKwik Pocket UPI KYC

To activate the MobiKwik Pocket UPI wallet account, you just need your Pan Card and your selfie. Here we will tell you step by step how to activate the MobiKwik Pocket UPI wallet and complete KYC within 2 minutes:-

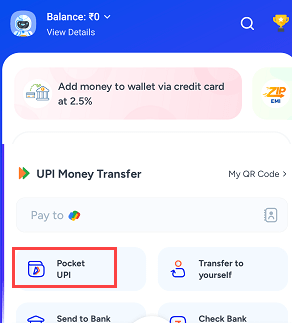

Step 1: Install the Mobikwik mobile application and register with your mobile number. Now login to your MobiKwik App and tap on the “Pocket UPI” option as you can see in the below screenshot.

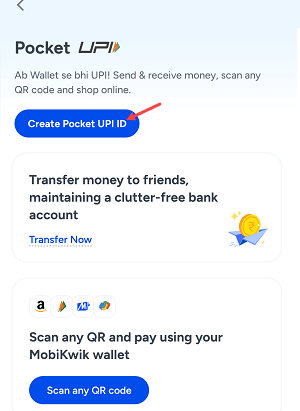

Step 2: Next screen, tap on the “Create Pocket UPI ID” option to activate and complete the KYC process.

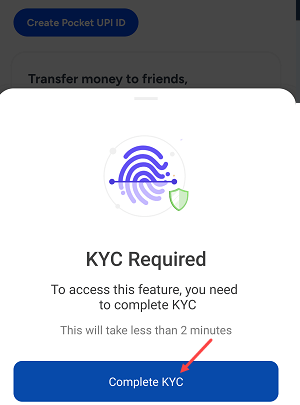

Step 3: Now you need to complete the KYC process which will take you just 2 minutes. Tap on “Complete KYC” and proceed.

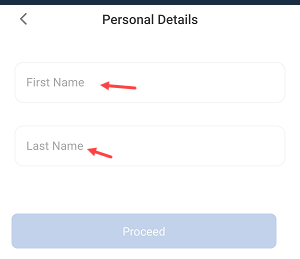

Step 4: Enter your First and last name as per Pan card and proceed.

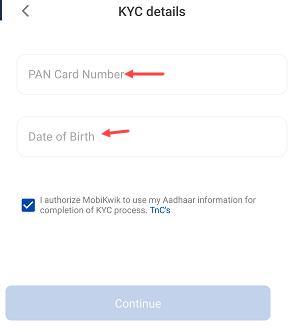

Step 5: Enter your PAN card number and Date of Birth and press the continue button.

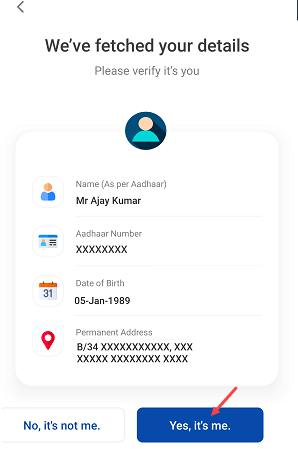

Step 6: Once you submit your PAN card details, your linked Aadhaar card details will be fetched and you can check your name as per Aadhaar, Adhaar number, Date of birth and address. If your fetched details are correct then tap on the “Yes, it’s me” button and proceed.

Step 7: In the final step, take a clear selfie and submit it for identity verification. Ensure that the background is clean and the photo is not blurry. Tap on the “Take a Selfie” button to capture your photo.

Step 8: Capture your clear selfie photo and tap on the “Use this” option to submit your selfie. If the photo is not clear then you can tap on the “Ratke” option to capture your selfie again.

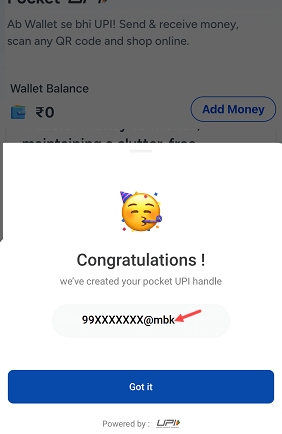

Congratulations! Your MobiKwik Pocket UPI wallet has been successfully activated and your KYC has also been completed. Your Pocket UPI ID is created successfully. Share this UPI ID to receive money to your Pocket UPI wallet from other UPI applications.

Now you can add money to your Pocket UPI wallet (Up to 2 Lakh) using your Debit card or send money to your Pocket wallet from other UPI applications through UPI ID and QR code. If your bank account is linked with MobiKwik then you can also add money to your linked account.

You can use your Pocket UPI wallet money for UPI transfers, make online payments and also pay at the shop without UPI PIN. You can send up to 1 lakh to any bank account using UPI ID, mobile number and QR code.

I hope this step-by-step tutorial has helped you successfully complete your MobiKwik Pocket UPI KYC activation.