Many ICICI Bank customer still don’t know about that the Bank offers digital mobile banking application called iMobile Pay to manage bank account online from mobile phone. You can install the application and activate it online and access many banking related services from your mobile phone.

Today we will guide you how to activate ICICI Mobile Banking (iMobile Pay) using Debit Card and Net Banking, so lets get started:-

Table of Contents

How to Activate ICICI Bank Mobile Banking (iMobilePay): A Step-by-Step Guide

Activating ICICI Bank’s mobile banking service, iMobilePay, allows you to manage your bank accounts, transfer funds, pay bills, and much more right from your phone. Here’s a detailed guide to help you set up and activate ICICI’s iMobilePay on your mobile.

Important Note Before You Start

Ensure that the mobile number registered with your bank is inserted in your phone. The iMobilePay app will verify your mobile number through SMS to initiate the setup process.

Step-by-Step Guide to Activate ICICI iMobilePay

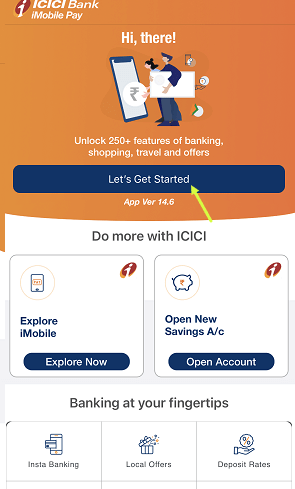

1. Install the iMobilePay Application

- Open the App Store (for iOS users) or Google Play Store (for Android users).

- Search for iMobilePay by ICICI Bank and download the app.

- Once downloaded, open the application.

2. Begin the Setup Process

- Tap on the “Let’s Get Started” button.

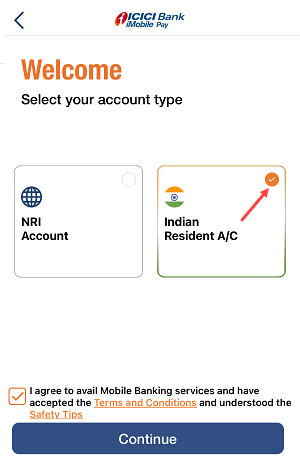

- Select the “Indian Resident A/c” option to continue with account activation.

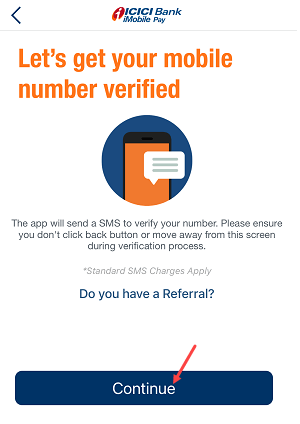

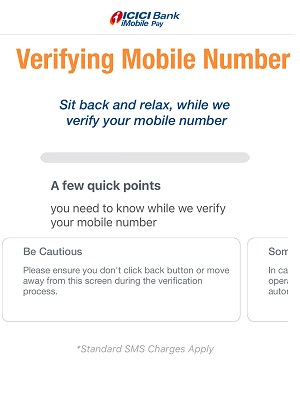

3. Verify Your Registered Mobile Number

- The app will automatically detect your mobile number and send an SMS for verification.

- Allow the app to send an SMS from your phone to verify the registered mobile number with your ICICI Bank account.

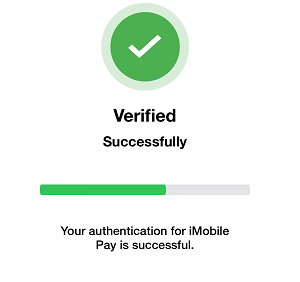

Note: If your mobile number is successfully verified, you’ll see a confirmation message.

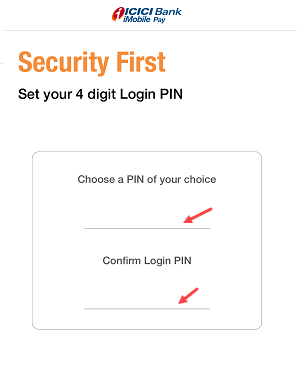

4. Set a 4-Digit Login PIN

- Choose a secure 4-digit login PIN to protect access to your mobile banking app.

- Re-enter the PIN if prompted, and proceed to the next step.

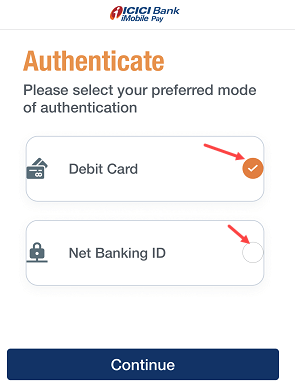

5. Choose Your Preferred Activation Option

ICICI Bank offers two options to activate mobile banking:

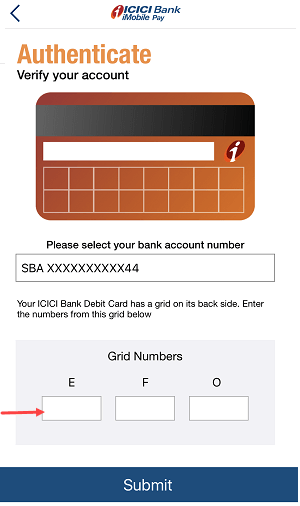

- Option 1: Using Debit Card

- Select the Debit Card option.

- Enter the grid numbers located on the back of your ICICI debit card. These numbers are unique to each card and provide an additional layer of security.

- Submit the details to complete the verification process.

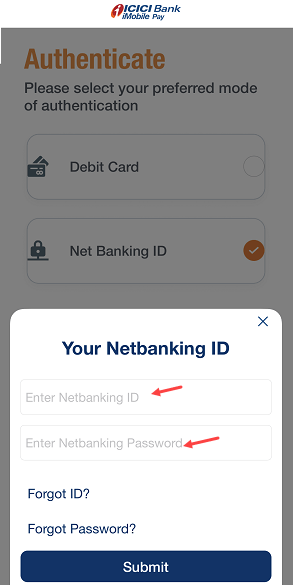

- Option 2: Using Net Banking

- Alternatively, you can select the Net Banking option.

- Enter your User ID and Login Password for ICICI’s online banking.

- Submit the credentials to activate your mobile banking access.

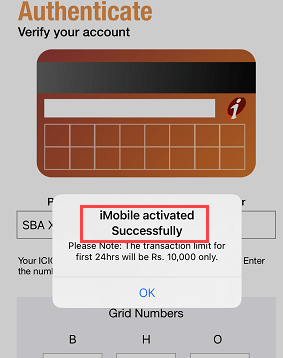

6. Confirmation and Access

- After successful verification and activation, you’ll receive a confirmation message.

- Congratulations! Your ICICI iMobilePay mobile banking is now activated.

Now, you can enjoy the convenience of banking on the go with ICICI Bank’s iMobilePay. With iMobilePay, you can transfer funds, check account balances, manage cards, pay bills, and much more—all from the comfort of your phone!

FAQs About ICICI Mobile Banking Activation

Q: Do I need an ICICI debit card to activate iMobilePay?

A: No, you can also use your Net Banking User ID and Password as an alternative to the debit card.

Q: Is iMobilePay safe?

A: Yes, iMobilePay employs multiple layers of security, including SMS verification, login PINs, and secure encryption, ensuring your data and transactions are safe.

Q: What should I do if I change my registered mobile number?

A: Contact ICICI customer support or visit your nearest ICICI Bank ATM to update your registered mobile number.

By following this guide, you can seamlessly activate and enjoy the benefits of ICICI Bank’s iMobilePay app.